Stockholders’ Equity and Net Assets

Definitions

Both Stockholders’ (or Shareholders’ or Shareowners’) Equity in a for-profit and Net Assets in a not-for-profit are both the difference in recognized assets and liabilities.

The amount of Equity or Net Assets is not an issue - it is automatically determined by the amounts of assets and liabilities. What is at issue is the nature of the transactions that gave rise to those net assets. In a for-profit, shareholders’ equity is generally separated into two types: that which arose from owners’ investments (often called “contributed capital” and that which was generated from the operations of the entity.

Stockholders’ Equity

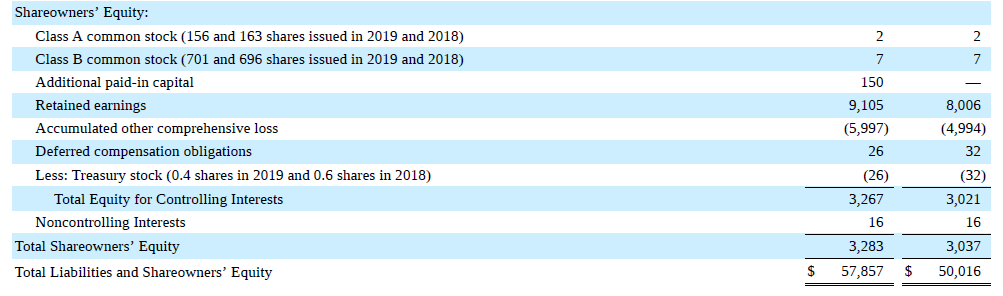

Here is the Stockholders’ Equity portion of the UPS’s balance sheet (UPS calls it Shareowners’ Equity):

Retained Earnings refers to the value generated through the operation of the company, less distributions to shareholders. Class A and Class B common stock, preferred stock, and additional paid-in capital, on the other hand, are the result of owner investments in UPS. Treasury stock reflects UPS’s repurchase of its own shares. Take careful notice of the fact that Treasury Stock is a contra-equity account, not an asset account. There is no future benefit to UPS of owning its own stock, and it did not repurchase them as an investment. In effect, buying back its own shares is a way to transfer some of UPS’s net assets to its shareholders.

An Aside

We have not researched why UPS has two different classes of common stock. Per the 10-K:

Our class A common stock is not listed on a national securities exchange or traded in an organized over-the-counter market, but each share of our class A common stock is convertible into one share of our class B common stock. Our class B common stock is listed on the New York Stock Exchange under the symbol “UPS”.

Further, the classes are registered under different sections of The Securities Exchange Act of 1934. Class A is registered under Section 12(g) and Class B is registered under Section 12(b).

Net Assets

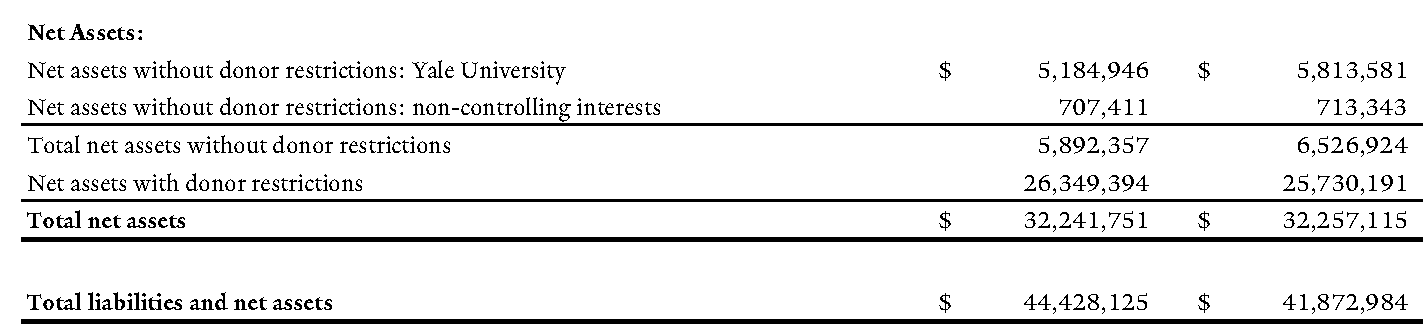

Here is the Net Assets section of the Yale balance sheet:

As a not-for-profit, Yale’s goal is not to generate net assets through its operations. Although some of its activities involve charging fees, its overall budget is funded about a third by income generated by its endowment which was raised through donors. Sometimes a donor gives money with no restrictions on it use. Of Yale’s $32.2 billion in net assets, $5.9 billion was given without restrictions (or was the result of earnings on assets donated without restrictions on net assets generated by their earnings). $26.2 billion was was result of gifts with restrictions on use (or was the result of earnings on assets donated with restrictions on the net assets generated by their earnings).

In a nutshell, what is important about Yale’s net assets is not whether they were from donations or from Yale’s operations. What is important is whether those net assets, however they originated, have restrictions on their use.

Conclusion

A balance sheet is an extremely important financial statement produced by organizations at the end of an accounting period to track economic benefits owned and owed. It reflects the most important identity in accounting - that all recognized assets must equal recognized liabilities plus stockholder’s equity or net assets, depending on the nature of the organization. Every transaction which enters the formal accounting system must be recorded so that this identity is preserved.

You likely found this section really abstract. Was that really necessary? Shouldn’t we have taken a more intuitive but less accurate path? Did we do all this just for the not-for-profit types?

To help you sort through these issues, do this case: