Assets

An asset is “a probable future economic benefit obtained or controlled by an entity as a result of a past transaction or event.” This usually means that an asset’s economic benefits will eventually manifest themselves in future cash flows, one way or another.

There are many different types of assets, but the most common are:

- Cash

- Accounts Receivable

- Property, equipment, etc.

Current & Noncurrent Assets

Assets are typically divided into current and noncurrent.

An asset is considered current if its economic benefits are expected to be realized within one year of the balance sheet date; otherwise, it is considered noncurrent.

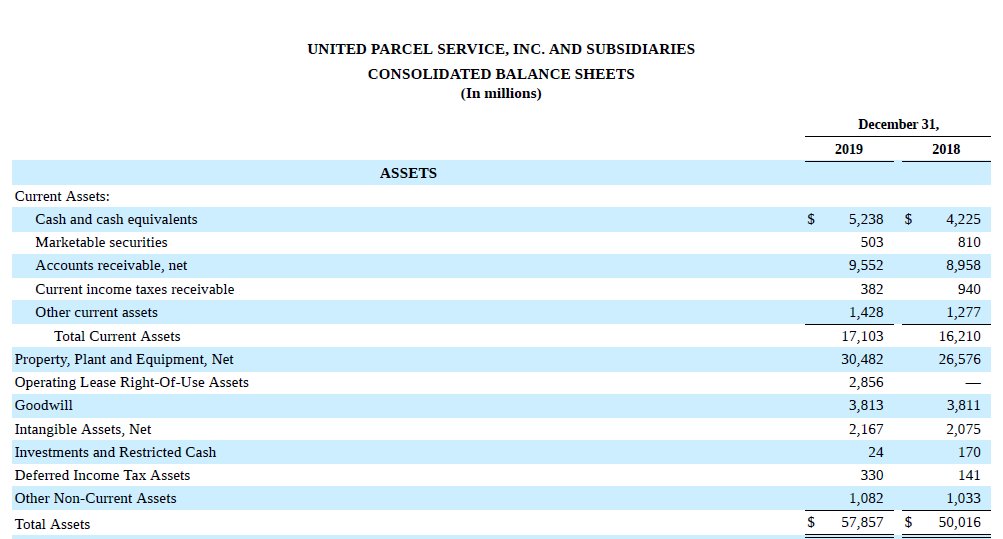

Here is the Assets section of UPS’s balance sheet:

As you can see, cash, marketable securities, accounts receivable, income taxes receivable and other current assets are considered current by UPS. That means that the company plans to use the economic benefits of these assets within the year of statement issuance. For example, its accounts receivable must be due to be paid this year as well as the income taxes receivable (must have gotten a tax refund). The property, plant, and equipment asset, on the other hand, is going to be used over multiple years and therefore is considered noncurrent.

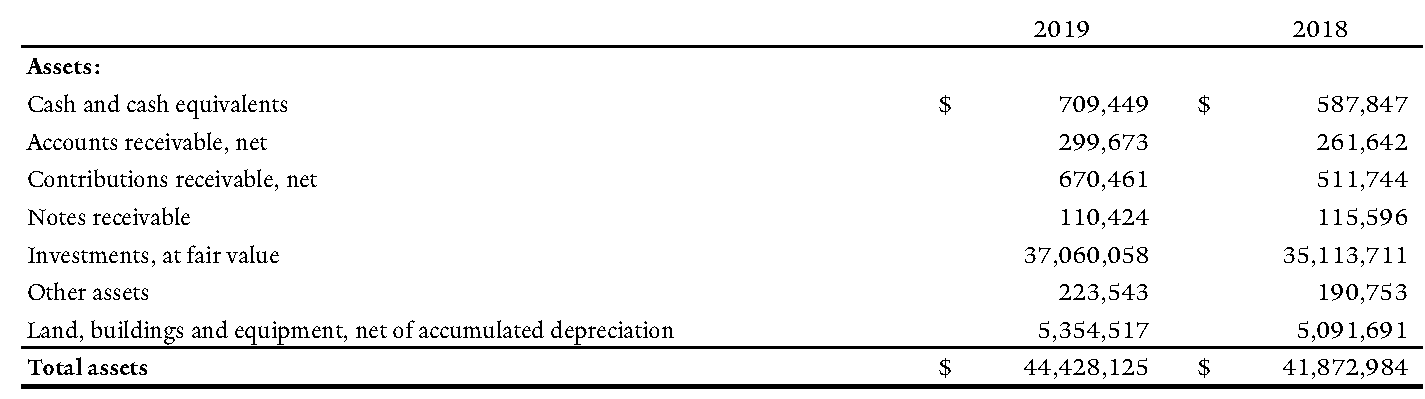

Here is the Assets section of Yale’s balance sheet:

As you can see, Yale does not label assets as current or noncurrent, but it does list the assets in order of liquidity. That is, assets that are more readily converted into or generate cash are listed before assets that will take longer to generate cash.

There are also many different ways to value an asset. When an asset is first acquired, it is recorded on the balance sheet at its cost. The justification for this is that, if it was acquired in an arm’s length transaction, both buyer and seller viewed the price as fair. So we set its initial book value equal to cost. How the initial book value is adjusted over time is a major focus of the course. Briefly, here is a rough guide to asset adjustments:

- Many financial assets are adjusted to “fair value” at each balance sheet date

- Tangible assets with finite lives are depreciated each period.

- Intangible assets with finite lives are amortized each period.

- Tangible and intangible assets are subject to an impairment when their future cash flows are less than their book values (cost less accumulated depreciation or amortization).

One of the nuances of accounting is that the book value of an asset (i.e., the dollar amount shown on the balance sheet) depends on all sorts of details about its history, and may be equal to its cost, its cost less accumulated depreciation or amortization, its cost adjusted downward by an impairment adjustment, or the amount it could be bought or sold for on an established market. We will explore these issues throughout the course.