Financial accounting writes the official financial history of an organization. It consists of capturing financial data, organizing it into useful categories, and issuing periodic financial reports. These reports contain a great deal of valuable information and are vital to stakeholders in for-profit businesses, not-for-profit organizations and even governmental entities.

Financial Statements

There are four main financial statements which get produced to showcase an organization's economic resources:

- Balance Sheet

- Income Statement

- Statement of Shareholders' Equity

- Cash Flow Statement

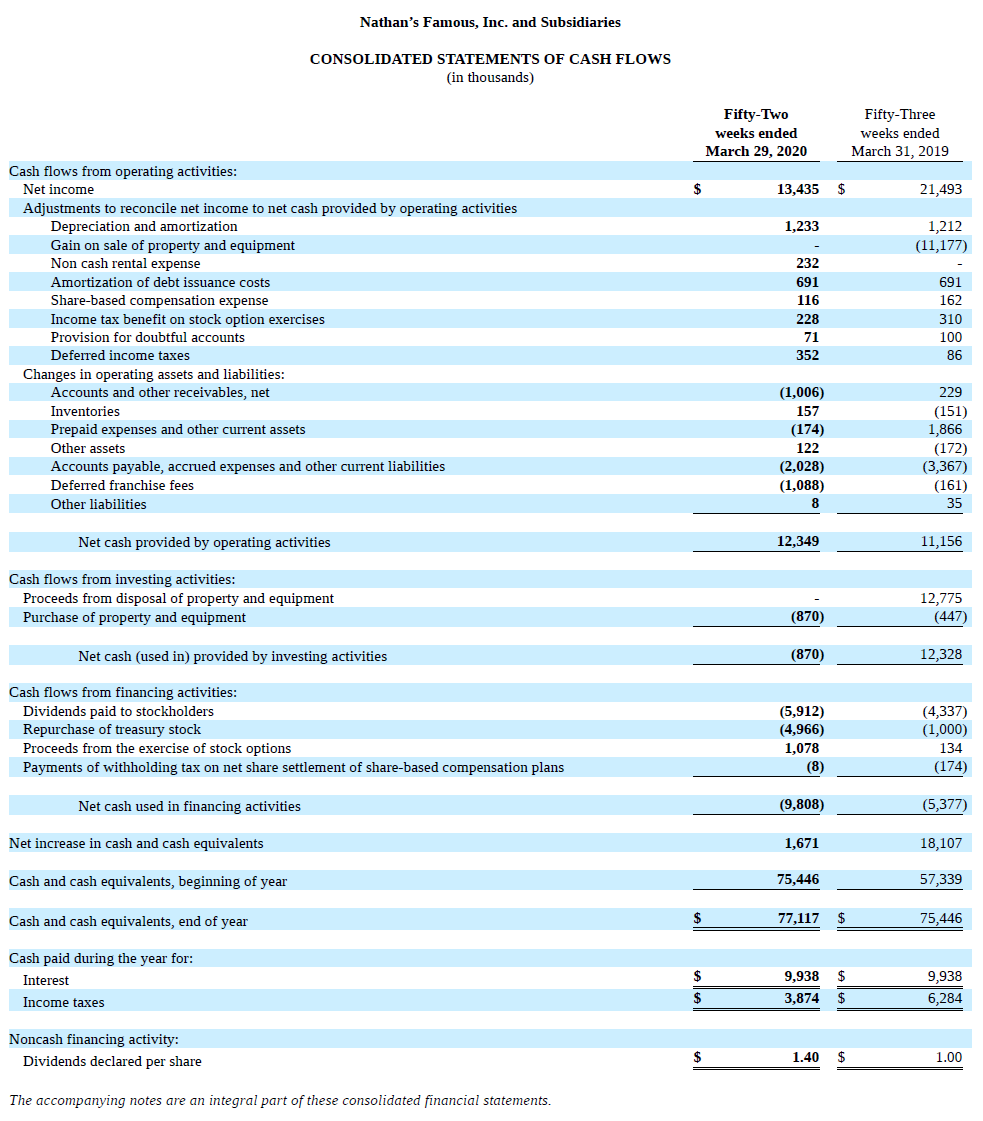

Balance Sheet

A Balance Sheet is a statement which shows resources owned (assets) and owed (liabilities) by the organization, as recognized by applicable accounting conventions, at a point in time. It also shows the excess (or deficit) of resources recognized over those committed.

Here is an example of two balance sheets, one for the beginning of Nathan's fiscal year (March 31, 2019) and one for the end (March 29, 2020):

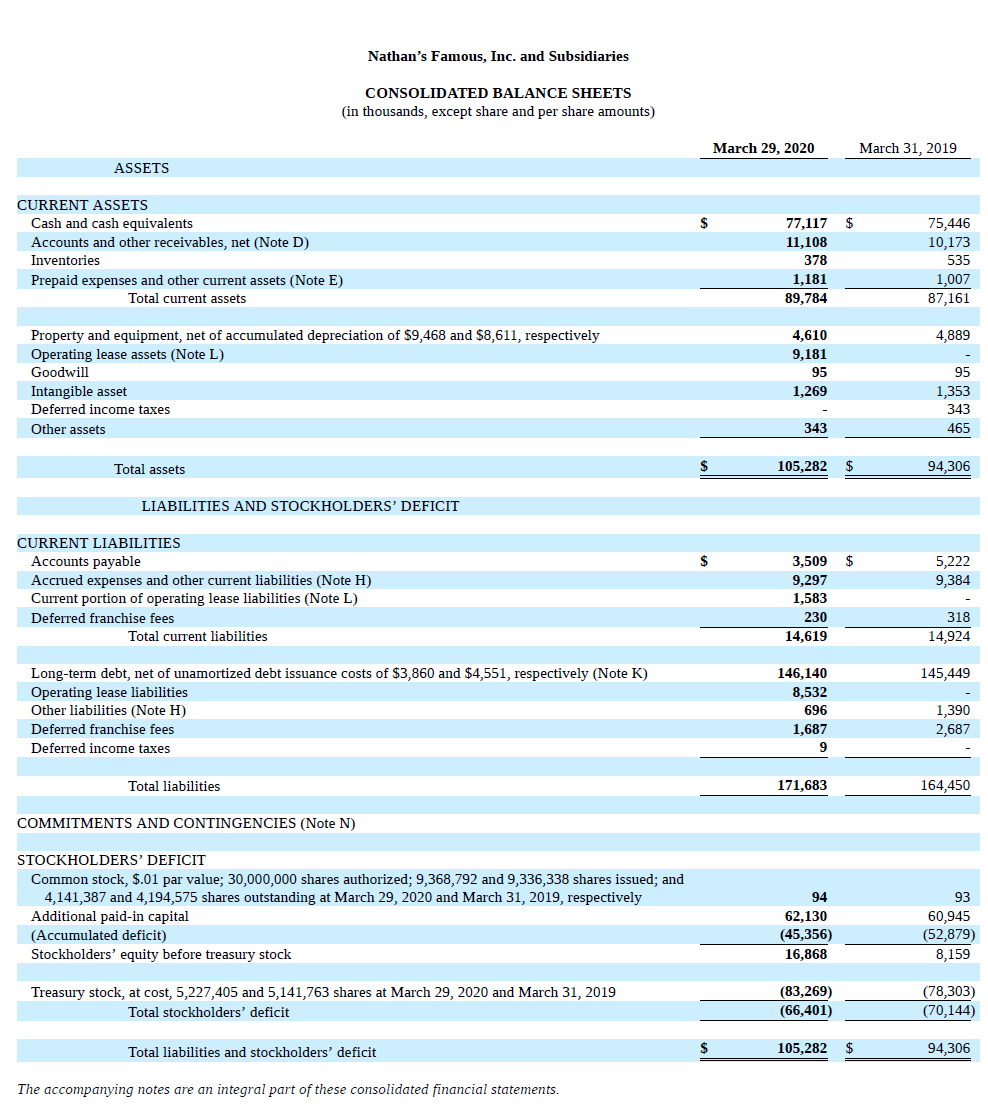

Income Statement

An Income Statement, on the other hand, provides a view of the economic resources acquired (Revenue) and consumed (Expenses) by an organization through its operations during a specific period of time. Here is an example of two income statements:

Notice the difference in the wording on the second line of the balance sheet and the income statement. A balance sheet is a statement “as of” of a certain date - it gives a picture of resources owned and owed at points in time. An income statement, on the other hand, is always for a period “ended” and only includes transactions and events recognized in a specific period. An income statement provides part of the reason the stockholder’s equity figure on the balance sheet changes from the beginning of the period to the end of the period.

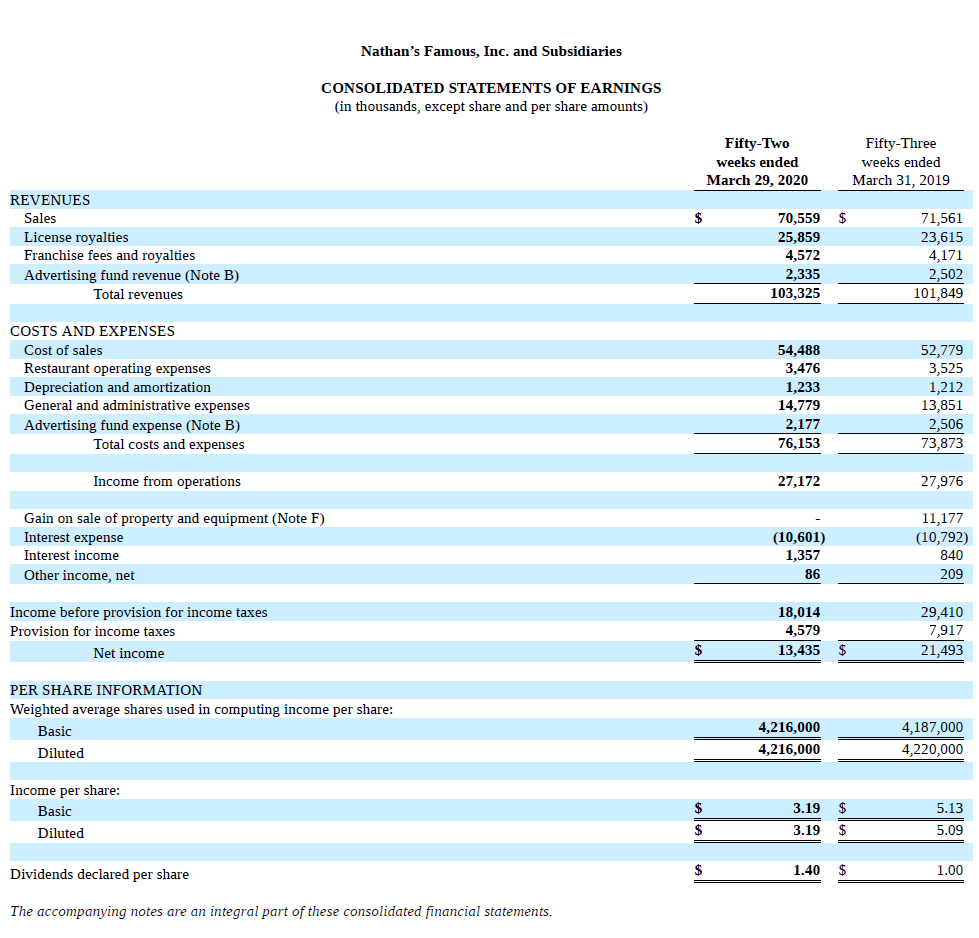

Statement of Shareholders' Equity

A Statement of Shareholders’ Equity (in the case of Nathan’s Famous, Inc., a Statement of Stockholders’ Deficit) of a for-profit company shows the details of the Equity section of the balance sheet, including why each Equity account changed over time. Here is an example:

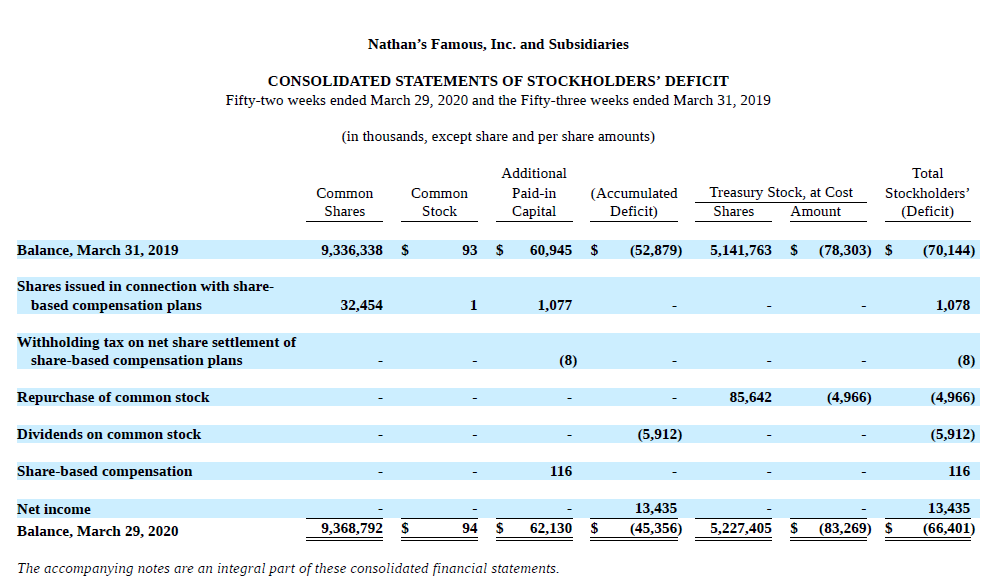

Cash Flow Statement

A Cash Flow Statement shows the flow of cash in and out of the organization during an accounting period. It is similar to an income statement in the way it only covers transactions for one period. The cash flow statement is used to explain the change in the cash balance on the balance sheet of the organization from one period to the next. All cash flows are classified as one of three types of activities that generated them - operating, financing, or investing activities. We will talk more about this classification later in the course. Here is an example of two cash flow statements: